DUNWOODY CITY COUNCIL

SPECIAL CALLED MEETING

JUNE 17, 2022 - 8:00 AM

DUNWOODY CITY HALL - DUNWOODY HALL

4800 ASHFORD DUNWOODY ROAD

DUNWOODY, GEORGIA 30338

Join from a PC, Mac, iPad, iPhone or Android device:

Please click this URL to join. https://dunwoodyga-gov.zoom.us/j/82640693855

Or One tap mobile:

+14703812552,,82640693855# US (Atlanta)

Public Hearing for Establishing 2022 Millage Rate

Presentation LinkFriday morning is the first of three public hearings that the City is holding to discuss a possible city tax rate increase that would fund

inflationary pressures for operational expenses, and as part of those inflationary preasures I am lobbying my fellow council members for a mid-year pay raise for our police department. Our City millage (Tax) rate has not changed in 13 years and we are currently burning reserves as we have done in other lean years but now the financial experts are estimating we can't do that very much longer and with higher operational costs facing the city, I believe it would be prudent to think about such a raise in 2023.

As

I discussed last Tuesday on my blog, our home values are locked for

City Tax rates (the Schools are not) therefore with no raise of the

actual millage (tax) rate, my city taxes have been the same since 2009.

My total DeKalb County Tax bill is $4,715 and of that I only pay $218

for general City Operations. Dunwoody has the lowest tax rate in the

County because we have so many

businesses that pay a large share of our taxes, we are able to keep

residential taxes low. My bill is similar to the home with the

$400,000 value listed below therefore if we decided to raise the tax

rate from 2.74 mills to the 3.04 mill cap, my expected tax rate might go

up $45 in 2023 for City Operational Services.

This

possible raising of the millage tax rate would bring in about One

Million Dollars and I believe that would be allocated very quickly for

Public Safety and other operational needs. Public Safety is Council's

highest responsibility and this possible tax increase would go a long

way to funding these increases.

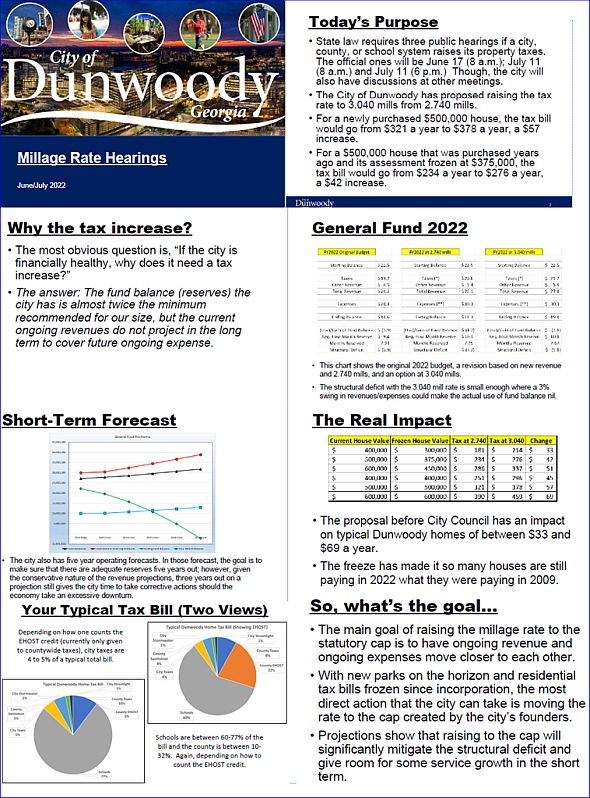

Press Release - The Dunwoody City Council is considering an increase to the city’s General Fund millage rate, matching the cap instituted by the city’s founders of 3.040 mills. This would result in an increase of $33 to $69 a year for a typical Dunwoody home.

“We have been watching closely the relationship between revenue sources and service expectations of residents and businesses,” said Dunwoody City Council Member John Heneghan. “We have found that the revenue sources proposed at the start of incorporation in 2008 do not match the current operational levels. We’re eager to hear the community’s input on funding options.”

The base service level for the city created in 2008 was based on a much lower level than expected today. For example, the parks budget proposed at incorporation would be about $450,000 today if indexed for inflation. Compare that to current operations and programming costs, which run about $3 million. For public safety, the current number of authorized police officers is almost triple what was recommended in 2008.

Dunwoody has never raised the millage rate before. As a result, revenue from residential property taxes has remained relatively flat, going from $2.88 million in 2008 to an estimated $2.94 million today. The city has one of the lowest millage rates (2.740 mills) in the area for cities that levy a tax. In addition, all homestead properties have a 1.000 mill exemption, effectively making the rate 1.740 mills. On top of that, all homestead properties in the area are eligible to have their property assessments frozen from any increase in city taxes.

A typical Dunwoody home assessed today at $500,000 does not pay city taxes on the full amount, which would equal $321. Instead, when the average freeze value is taken into account, that same house is taxed as if it is assessed at $375,000, and the city taxes drop to $234. Raising the millage rate to the cap of 3.040 mills would be an additional $42 a year. Note that the freeze does not include school taxes.

City Council passed the 2022 Budget with a known structural deficit in the General Fund. Starting with the onset of COVID, the city proactively dropped revenue and proposed using fund balance to maintain operations. But in neither year (2020 nor 2021) did the city use any fund balance, so it grew.

When this year’s mid-year revenue numbers were reviewed, the deficit shrank to $2 million from the previous projection of $3.9 million. This millage increase would change that structural deficit to approximately $1 million.

A city can have a high fund balance and still have a structural deficit. In those cases, fund balance is generally used to keep operations at the same level. One-time costs, such as the contributions to the Arts and Nature Center, are not considered ongoing costs and do not count against the structural deficit.

Staff has recommended advertising the millage rate for 2022 at 3.040. Dunwoody’s Mayor and City Council invite the public to provide input during three public hearings on the millage rate at Dunwoody City Hall:• Friday, June 17 at 8 a.m. • Monday, July 11 at 8 a.m. • Monday, July 11 at 6 p.m. – this public hearing will be followed by a vote by Council

Raising the millage rate to 3.040 would generate approximately $1 million of new revenue. Staff recommends that $250,000 of this increase be earmarked for pay adjustments for staff, including police, in the third or fourth quarters to continue being competitive with neighboring jurisdictions. The rest of the increase is recommended to be used to shore up the structural deficit. All combined, these actions should reduce the structural deficit to approximately $1 million. If approved this increase would appear on the tax bills sent out this fall. The city’s tax share of most tax bills represents only 5% of the overall total bill.

No comments:

Post a Comment