Tuesday, February 21, 2017

Dunwoody City Hall

41 Perimeter Center East

Dunwoody, GA 30346

Watch Live at 8:00 a.m.

Dunwoody City Hall

41 Perimeter Center East

Dunwoody, GA 30346

Watch Live at 8:00 a.m.

Agenda

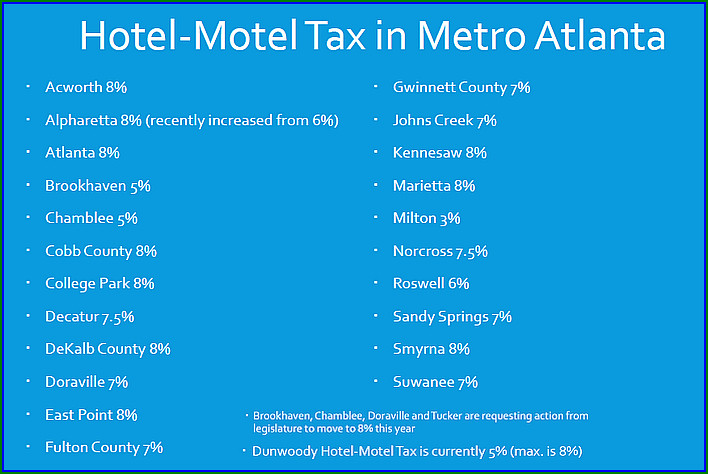

Heneghan comment - The Dunwoody City Council set the hotel tax rate of 5% back in 2009 and raising it has not been discussed previously. Other nearby cities are about to offer a bill in the state legislature to raise their hotel tax rate and our hoteliers along with the Dunwoody Convention & Visitors Bureau are favorable of the rate increase here in Dunwoody. I believe the reason for this special meeting was to pass this reolution to make a state legislature deadline to be added to a tax increase bill being drafted for other cities. Neither this act or the act of the state will raise the taxes but both together would allow us to come back and set the final rate if appropriate and projects are tied to the revenue.

I will be missing the meeting in the morning but I believe the additional revenue would eventually need to be earmarked on items benefiting the hotel guests, possibly nearby park amenities, dedicated paths to restaurant areas or shopping; if that is not the case per law - it would be my desire to spend the additional revenue benefiting those who pay the taxes. A slide presented to Council during our retreat states that the revenue must be for physical attractions/facilities that are available and open to the public, improve destination appeal to visitors, and used by and supportive of the visitor experience. If that is the case, I would be interested in learning those project details as I do not believe they are completely hammered out. John

To approve a resolution requesting state to allow Council to vote for authorization to increase the City’s hotel tax rate to an amount not to exceed 8%.

Presently, the City has a 5% hotel excise tax for the room and authorized related charges. For 2016, each percent yielded tax revenues of $533,837 to be used as required by state law. Dunwoody may levy and collect an excise tax of a rate of up to 3 percent or at a rate of 5,6,7 or 8 percent on charges made for rooms, lodging or accommodations furnished by our hotels. Under state law, Dunwoody may do so only after the passage of local legislation authorizing the tax.

As an initial step, after consulting with relevant destination marketing organizations, hotel owners, and others in the tourism industry, any city considering an increase in its tax rate will adopt a resolution stating the proposed new hotel-motel tax rate, the allocation of proceeds, and the projects, if any, that will be funded by the tax. This resolution does not set Dunwoody’s tax rate. Neither will the state legislation being requested by the resolution. It merely adds a tool to the tool chest that allows Council to consider and subsequently adopt an appropriate amount to be used in accordance with state law. That rate and use will be vetted and considered at a later time; allowing vested parties to participate in the process to both set the rate and identify the usage.

Under the new process, the city is required to spend the tax revenues that would be collected at the rate of 5 percent in accordance with the general 5 percent tax rate authorized in O.C.G.A. § 48-13-51(a)(3). At least half of the tax revenues collected in excess of amounts that would be collected at the rate of 5 percent are required to be spent through a contract with a destination marketing organization (CVBD) for purposes of promoting tourism, trade shows and conventions. The remaining revenues, if any, collected in excess of amounts that would be collected at the rate of 5 percent are required to be spent for tourism product development.

ALTERNATIVES

Council may choose to reject or postpone the resolution. Such action will prevent the legislation from being adopted at the state level due to deadlines for advertising and consideration by state representatives.

RECOMMENDED ACTION

Staff recommends the Council approve the resolution asking the state to authorize the City to adopt a hotel tax rate not to exceed 8% to be used in accordance with state law.

No comments:

Post a Comment