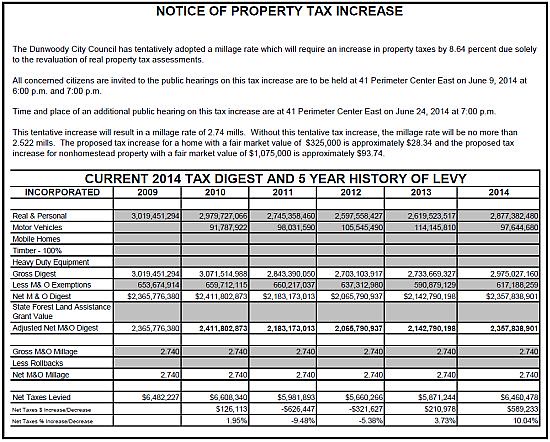

The City of Dunwoody will consider setting the

millage rate for real estate at a maximum of 2.74 mills following the recent

revaluation of real property tax assessments, preserving the same mill rate

since incorporation in 2009.

The City received notice of

its second year-over-year increase in the real and personal tax digest for 2014

as a result of the revaluation of real property tax assessments.

Notwithstanding this increase in the overall tax digest for real property, the

digest has dropped by approximately 5 percent since the City’s incorporation in

2009.

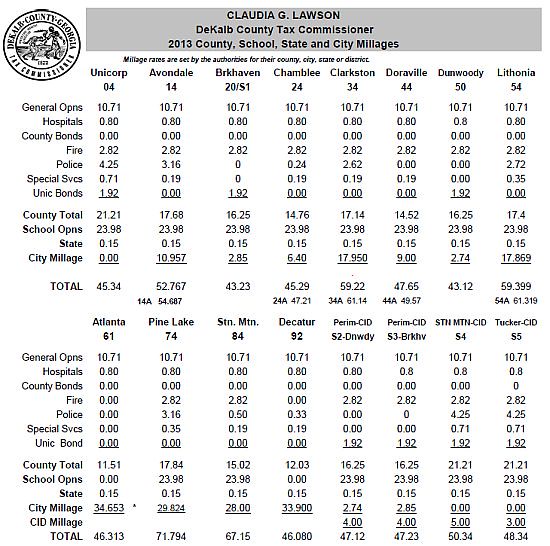

By keeping the millage rate

at 2.74 mills since incorporation, one of the lowest millage rates of any

similarly-sized city within the immediate Atlanta metro area, Dunwoody property

owners may see an increase or a decrease in their real estate taxes in 2014,

depending on whether individual property gained or lost value this year. The

City of Dunwoody does not have direct control or influence over the valuations

of the tax assessor’s office.

In accordance with state law

requirements, the City of Dunwoody will hold three public hearings to receive

comment from taxpayers on aspects of the recent revaluation of real property

tax assessments. The public is invited to attend information meetings on June

9, 2014 at 6:00 p.m. and again at 7:00 p.m. at City Hall located at 41

Perimeter Center East Dunwoody, Ga. 30346. The City will hold an additional

information meeting on June 24, 2014 at 7:00 p.m. at City Hall. The City Council will vote on

a final tax rate for FY 2014 on June 24, 2014 at 7:00 p.m.

No comments:

Post a Comment