Crown pulls development application before Council vote.

https://www.bisnow.com/atlanta/news/mixed-use/crown-pure-office-possible-sale-back-on-table-60493

http://business.blog.myajc.com/2016/05/23/crown-towers-project-up-for-key-rezoning-vote/

16-story office building planned for Perimeter Center in Dunwoody

http://www.reporternewspapers.net/2016/05/24/16-story-office-building-planned-perimeter-center/

City holds park survey meeting Tues night - more details released Wed a.m.

http://www.jkheneghan.com/city/meetings/2016/May/ParksFindingsPresentationPublic_Final.pdf

Contested projected election winners - State Senate Fran Millar, State Representative Tom Taylor, DeKalb DA Sherry Boston, DeKalb CEO Mike Thurmond, DeKalb School SPLOST passes, DeKalb Commission Kathie Gannon, DeKalb Judge Seeliger. Kudos to Stan & Nancy Jester for continuing your service to Dunwoody.

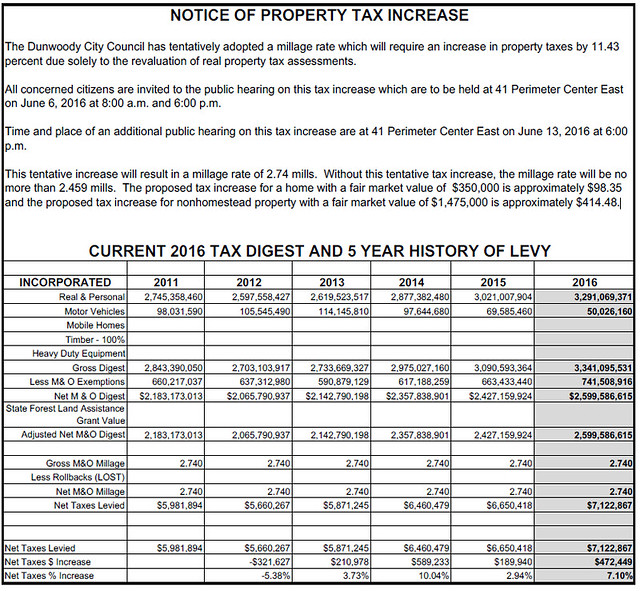

2016 Real Estate Valuations Issued For Dunwoody

City’s Millage Rate of 2.74 Will Not Rise

The city received notice of its fourth

year-over-year increase in the real and personal tax digest for 2016 as a

result of the revaluation of real property tax assessments performed by the

DeKalb County Tax Commissioner’s office. Notwithstanding this increase in the

overall tax digest for real property, the digest is relatively unchanged having

increased less than 8 percent since the city’s incorporation in 2008.

Dunwoody homeowners who filed and

qualified for a homestead exemption will pay no more in city taxes than the

amount they paid in 2009 based on the residential property assessment freeze

exemption effective since the city’s inception. This exemption is in

addition to the one (1) mill exemption also in place granting homeowners in

Dunwoody an effective millage rate of just 1.74 mills.

By keeping the millage rate at 2.74 mills since

incorporation, one of the lowest millage rates of any similarly-sized citywithin the immediate Atlanta metro area, Dunwoody property owners may see an

increase or a decrease in their real estate taxes in 2016, depending on whether

individual property gained or lost value this year. The City of Dunwoody does

not have direct control or influence over the valuations of the tax assessor’s

office.

In accordance with state law requirements, the

City of Dunwoody will hold three public hearings to receive comment from

taxpayers on aspects of the recent revaluation of real property tax

assessments. The public is invited to attend information meetings at Dunwoody

City Hall located at 41 Perimeter Center East Dunwoody, Ga. 30346 on:

·

June 6, 2016

at 8:00 a.m.

·

June 6, 2015

at 6:00 p.m.

No comments:

Post a Comment