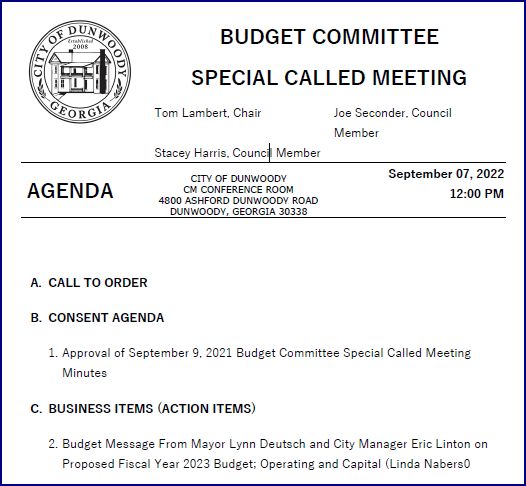

This Budget Committee Meeting is scheduled to discuss the Mayor's Budget for two days but it will likely only take the afternoon of the 7th. This meeting is open to the public and the three committee members (Tom Lambert, Joe Seconder & Stacey Harris) will go line by line of the Mayor's plan asking questions and possibly tweaking here and there. Even with the 2022 raise to the maximum millage (tax) rate which went mostly for police raises and increased health care costs; the city will be operating with thin margins because of continued rising expenses.

The Mayor's budget message expresses this same concern in her closing statement as follows ...

During incorporation, models were designed with a service level that is not the service level expected by the current citizens. The revenue side of the equation has only recently changed in an effort to match these expectations. However, more revenue will be needed to continue to continue matching in the future. On top of that, the idea of devaluation of the commercial tax digest on which the City was based is not that much of a stretch to think about.

When those factors are combined, the City has some critical thinking ahead.

The City of Dunwoody's financial (revenue) structure is very different then other neighboring municipalities because in our Charter we have frozen residential assessed values and a one mil reduction given to all homesteaded properties as part of our city charter; our tax base doesn't rise like our neighbors who do not have that assessment freeze. Our maximum ad valorem tax rate on real property is now in place and any general increase in those taxes would need to go in front of the citizens as a referendum.

Sec. 5.08. - Homestead exemption; freeze.

Sec. 5.12. - Homestead exemption; one mill equivalent.

Sec. 28-20. - Maximum rate.

Short term, we are ok as we have built up some reserves but long term tough decisions will need to be made. We can no longer easily raise the general tax rate to meet expenses, therefore we need to either start scaling back capital expenditures, reduce operating expenses, or find ways to increase revenues to match the amenities desired by the community.

Does that mean attempting to change the charter, eliminating the assessment freeze, the one mil rollback and/or removing the maximum tax cap? I believe these are decisions for the state legislature (with possible referendum of the city citizens) as I do not believe that the City Council can take unilateral actions to change the charter.

As an aside, the One Mill rollback is the one item that may make sense to remove because it was placed in the charter to equal / take place of another tax break that is no longer in use or was already given back to the citizens, thereby the intention of the legislature who decided this tax reduction has already been fulfilled therefore this one mill rollback is really a double dip of what was corrected by other means. (If I am wrong, I am sure I will be corrected by those who were involved during incorporation.)

I am sure Council will be discussing our Legislative agenda for the State Legislature soon and I wouldn't be surprised if our charter was discussed. As an fyi, the Charter Commission discussed some of these items and their final recommendations were approved by Council in March of 2021 and pushed forward to the DeKalb Delegation for consideration. I don't believe any actions were taken as they were working COVID priorities?

Looking back at our proposed budget, I see paving funds are on track or similar to previous years. The last couple of years (this one included) a small portion of the planned street paving funds were moved over to pedestrian projects, many of which are listed on page 46 of the budget.

I see a good chunk of money going to Path development that I am not sure we are handling correctly or is the wisest use of funds therefore I will continue questioning what we are doing trying to obtain win / win situations for all involved including the resident that might be forced to have a 12 foot sidewalk in front of their home. Wide sidewalks without shade and beauty, is not what I believe this community wants and I will continue raising the question. The paths on Ashford Dunwoody will connect all the way to Mount Vernon and the Old Spring House path may be looking along the highway or completing though the business zone (I will need to explore that one more as to residential impacts).

The $500K for Vermack is for ADA work & a 12 foot Path (sidewalk) in front of Dunwoody High School whereby some parking will be removed and unsure of other tree loss as this area is tight for 12 feet of concrete. I voiced concerns and am looking forward to final design prior to final approval.

I see $600K for matching funds to look at possible changes to the Dunwoody Village Shopping Center owned and operated by Regency. These funds are an enticement to bring Regency to the table to invest in the center, to imagine changes, new streets, new buildings, new public spaces and hopefully this investment in an updated street grid will effect change.

Finally let's see what is not listed in the budget and namely it is the construction of our two newest parks on Vermack & Roberts, sidewalk completions, new restrooms at Brook Run, and everything else that the capital committee was looking at previously.

One item missing from the budget has been discussed for years and that is installing turf on the Peachtree Middle School football field - Dunwoody

has a 20 lease on the football field at PCMS and the field is in really

bad shape to where we can not maintain it to our standards, therefore since we have already invested in the lease, the lights, a storage facility

that it would make financial sense to turf that field so that the

usable playable hours greatly increases and the field could be used for

Lacrosse and Football as those spaces are also in high demand. This

idea is not applicable for a bond because first an IGA modification

would be needed with DeKalb Schools and there is an argument that we

don't own the land therefore it should not be completed with bond funds. But to me, putting a

twenty year turf on land with a twenty year lease sounds acceptable to me as a win

/ win situation for all involved. This project can be done with city funds outside a

bond and if I was on the budget committee I would argue to fund a portion of the expense in 2023, complete it in 2024 and the rental charges would defray the ongoing expenses. The IGA could be updated this year, and once the updated field was built it could assist numerous children and area sports teams for both Lacrosse, Football and Soccer for many years, because right now the City of Dunwoody has the responsibility to maintain the turf and it is very hard to do with constant use.

On Monday the Council is creating a Citizens Advisory Capital Improvements Committee which shall be a temporary committee, charged with responsibility of reviewing Dunwoody’s capital improvements needs and providing input and recommendations to the Mayor and City Council regarding capital needs and projects. Meetings are scheduled to take place weekly on Wednesday evenings at City Hall from 6 to 7:30 starting September 14 & concluding Wed, December 7th. The proposed members as nominated by Council to the Mayor to discuss capital desires of community are as follows: Remi Bullard, Abby Lesorgen, Steve Ellet, Joe Martinez, Su Ellis, Mereca Smith, Brian Gee, Sarah Smith, and Max Leighman

FYI - As we have no funding source currently for these capital projects, I am guessing a conversation on a possible bond referendum will then follow at some time in the future after the Citizens list is finalized. As new capital improvements sometimes cause new expenses, we will need to consider the added expenses from everyday revenue as bond referendums can not be used, therefore as the Mayor says, the City has some critical thinking ahead.

Once the Budget Committee approves / tweaks the Mayor's Budget, there will be numerous public hearings and scheduled sessions for feedback prior to full Council approval.

3 comments:

Hi John,

Thank you for you run-up on recent Council developments regarding potential Charter changes, revenue/expense projections and the Citizen Committee.

I am unable to fulfill any duties on the Citizens Committee due to out of town family business that may make it impossible to attend these meetings. I communicated this to our Mayor.

That said, I am shocked to learn that 'plan' is to make an attempt to shift the responsibility for eliminating the property tax freeze, among other items, to the General Assembly. City Council owns the spending issues that have lead us to this point.

In fact, blaming the property tax freeze as a main reason for our deficit is suspect.

I totally agree with Max. What is going on??

Max, not blaming on my part just foreshadowing what I am hearing might happen. See the budget meeting summary and as I wasn't there, it's the first I am hearing of some aspects raised. Excited to learn more on some new issues and I have questions on others.

https://dunwoodyga.hylandcloud.com/211agendaonline/Meetings/ViewMeeting?id=2555&doctype=3

Post a Comment