Saturday, June 9, 2018

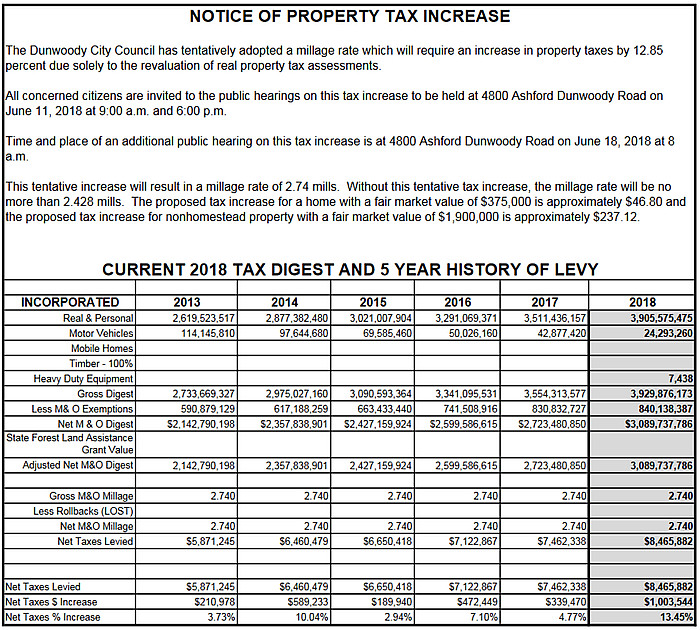

Dunwoody tax rate has been steady since incorporation but with values rising it is a proposed 13% tax increase this year. Time for our first rollback?

Property taxes are an ad valorem tax, meaning that they are allocated to each taxpayer proportionately according to the value of the taxpayer's property. The millage rate is the rate at which property taxes are levied on property. A mill is 1/1000 of a dollar. Property taxes are computed by multiplying the taxable value of the property by the number of mills levied.

Dunwoody’s millage rate is currently 2.74 mills and has remained constant since the city’s incorporation in 2008. Property taxes are a primary source of funding for Dunwoody and account for about a fourth of the city’s revenues. These funds are used to pay for a variety of services including police; new parks and park improvements; new road construction and other infrastructure projects; and the operations, including salaries, of the city employees and contractors.

The Dunwoody City Council has a decision to make in a few weeks as to the tax rate being levied in 2018 as property valuations have risen and therefore more money will be entering the city treasury. The Council could either keep the same tax rate or decide to roll it back a bit.

There are two sides of the argument, one is that there are needed improvements within the community be it roads, parks or police services and the additional money could easily go towards those needs and the other side of the coin asks why should the City have an extra million dollars when it wasn't anticipated therefore return the money down to a level to ensure that there is fiscal responsibility in spending policy.

If specific funds are needed for special long term investments (like park development & infrastructure) then there is a mechanism for doing so called a Bond Referendum whereby the city proposes a list of projects with anticipated costs and the citizens decide via an election if they would like to raise their taxes for these specific improvement to be installed sooner rather than later. The City of John's Creek put forward a parks referendum in order to upgrade parks and turf fields in 2016 and they are now seeing the fruits of the investment.

With the typical Dunwoody real estate bill (here is a 2016 sample) the average Dunwoody homeowner currently pays a little over $200 for the city taxes to cover the services of paving, parks and police and it looks like under the current proposal that could go up an additional $46.00. The proposed 13.45% raise in revenue is a large jump to grow city general operations in one year therefore I believe community discussions need to be had regarding the possibility of Dunwoody's first ad valorem tax roll back for general operations and a possible bond for long term infrastructure improvements that the community may want now and not installed over time. Thoughts?

I am looking forward to hearing your thoughts on this topic therefore all concerned citizens are invited to the public hearing on the proposed ad valorem tax rate to be held at Dunwoody City Hall, 4800 Ashford Dunwoody Road on Monday, June 11th, 2018 at 9:00 a.m. and again at 6:00 p.m.

Subscribe to:

Post Comments (Atom)

3 comments:

Here is a vote for no (or smaller) tax increase = vote for ad valorum rate roll back.

I do not advocate for a city tax roll-back to counter DeKalb's increase in property values. Money in the bank is never regretted.

I feel like homeowners are getting disproportionally screwed by this.

If you look around, there are an increasing number of homes with more residents (in said household), along with renters (whose tax is paid via owner) and a growth in businesses.

So why not have State Farm pay more? Or Cox (if they're in Dunwoody)?

Or the retailers who OVER-utilize Dunwoody services (police) for shoplifting (police) and other related crimes (police).

Post a Comment